The fixed and multi-year pricing of its catastrophe bonds acts as an effective hedge against future reinsurance rate rises, according to Heritage Insurance CEO Bruce Lucas, something that is especially pertinent as major hurricane Irma tracks towards the United States.

Like other Floridian primary insurers, Lucas’ company wants to highlight its reinsurance protection, in advance of any potential impacts from hurricane Irma.

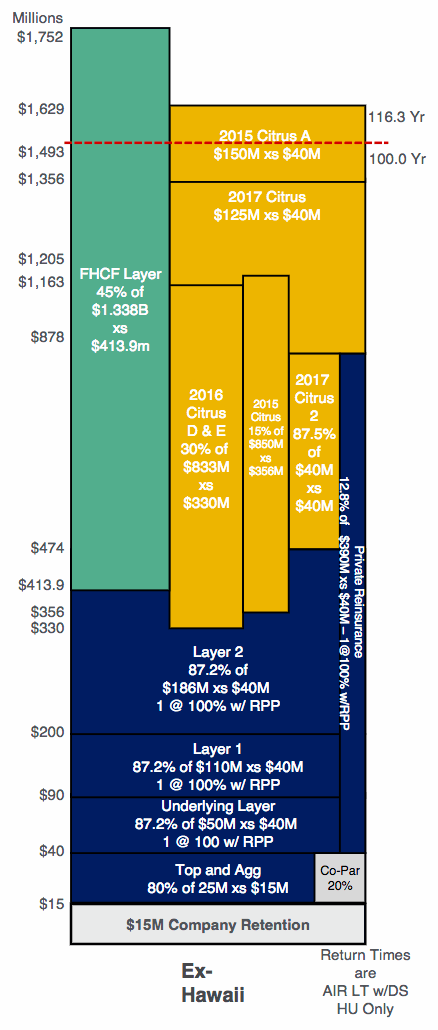

Heritage subsidiary Heritage Property & Casualty Insurance Company is protected by $1.75 billion of catastrophe reinsurance protection, which exceeds the requirements of its rating agency, Demotech, Inc., and the Florida Office of Insurance Regulation.

The reinsurance program means that Heritage has a consolidated retention of around $20 million pretax before reinsurance kicks in and begins to pay its losses.

The catastrophe bonds are a key component of this reinsurance program, offering multi-year, fixed cost and flexible (due to their annual resets) certainty to the insurer, which is especially important when major hurricanes threaten its heartland of Florida.

Bruce Lucas explained; “With the approach of Hurricane Irma, it’s important to remember that our current year’s program reduced our windstorm retention by half from $40 million to only $20 million for the first catastrophic event. We have approximately $1.75 billion of first event reinsurance in Florida.

“To put this amount in perspective, Hurricane Andrew, a powerful category 5 hurricane that struck southeast Florida, is estimated to produce a gross loss on our portfolio of $813.1 million. Furthermore, our reinsurance models provide that even after enduring a Hurricane Andrew loss, Heritage will only have exhausted approximately 30% of its catastrophe reinsurance.

“Since we were not exposed to Harvey losses in Texas or Louisiana, and we do not cover flood losses, our Q3 results should closely approximate our prior guidance, which would be offset by an amount up to $20 million pretax if Irma makes a Florida landfall. Heritage had approximately $189 million of statutory surplus as of June 30, 2017.”

This level of reinsurance protection is not uncommon among Florida focused primary insurers, which Heritage was until its expansion in recent years and it explains why the majority of analysts believe that if hurricane Irma makes landfall it will be more of a reinsurance loss than insurance, as so much protection is in-force.

Highlighting the importance of the catastrophe bonds to Heritage and exactly why they have become a major component of its reinsurance arrangements, Lucas said; “Heritage also has over $600 million of multiyear catastrophe bonds with set pricing. This fixed pricing provides a hedge against future reinsurance rate increases that is unique in the Florida market.”

Should Irma strike Florida, the fixed pricing of the cat bond coverage will show its worth if reinsurance pricing was to rise, giving Heritage some certainty over its costs and reducing the amount of top-up cover it may need after a major event.

You can see Heritage’s reinsurance program for the U.S. below, including all the Citrus Re cat bonds.

So over one-third of Heritage’s reinsurance is from catastrophe bonds, with more of the program likely provided by collateralized reinsurance markets and ILS players via fronting arrangements as well, meaning the ILS market holds a significant amount of Heritage’s exposure to Irma.

That is also the situation with many other Florida primaries and regional insurers, which also make significant use of the capital markets for reinsurance.

Hence if there is a major Irma loss, the ILS market and its investors will be on the hook for a relatively significant share of the total bill from insurers such as Heritage. That’s why ILS markets have become such important partners for primary insurers and will likely continue to, as they may be able to offer greater continuity post-event as well (if they can recapitalise faster than the traditional market).

Track Irma and every other hurricane of the season with Artemis here.

Also read:

– Irma & Harvey losses combined may still just be an earnings event: Morgan Stanley.

– Citrus Re 2017 cat bond notes trade down 50% on hurricane Irma threat.

– Hurricane Irma live cat activity focused on $40bn+ loss, pricing uncertain.

– Hurricane Irma landfall in Florida would hit reinsurers hard: KBW.

– Hurricane Irma a potential U.S. (Florida) threat this weekend.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.