Risk modelling firm AIR Worldwide has estimates that wind and storm surge damage related insurance industry losses from hurricane Harvey will range from $1.2 billion up to $2.3 billion, a figure set to fall far below the final flood related economic and even insured loss tally.

AIR notes that its estimate is solely for hurricane and tropical storm wind losses as well as storm surge related losses that the insurance and reinsurance industry could pay for. The catastrophic and ongoing flood event is not estimate currently, although AIR says that it expects the impact of that to be “significant.”

AIR notes that its estimate is solely for hurricane and tropical storm wind losses as well as storm surge related losses that the insurance and reinsurance industry could pay for. The catastrophic and ongoing flood event is not estimate currently, although AIR says that it expects the impact of that to be “significant.”

The industry loss estimate for wind and surge is perhaps surprising low, given the ferocity of hurricane Harvey as a Category 4 storm. But the areas worst hit by winds are not as highly populated as previous Texas hurricanes have encountered, resulting in a lower expectation of losses.

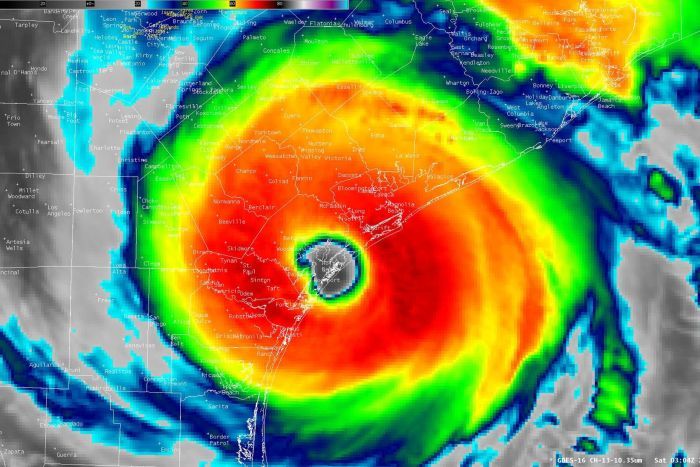

Hurricane Harvey had winds at landfall of around 130 mph, with hurricane-force winds extending 40 miles from the center and tropical storm-force winds extending 140 miles. The storm surge was estimated at 6 to 12 feet.

AIR explained some of the wind damage seen:

In Rockport, TX, just 4 miles west of the landfall location, damage was severe; masonry walls collapsed, wood frame homes were shattered, roofs and metal siding were peeled off, mobile homes were overturned, and trees were uprooted.

According to NOAA’s Storm Prediction Center, preliminary reports of 21 tornadoes were recorded in Texas from Friday night through Saturday, including one in Sienna Plantation early Saturday morning that ripped off roofs and caused severe tree damage.

In Corpus Christi (est. pop. 325,000), downed trees, debris, and power lines blocked roadways, signs were blown down, and some roofs were at least partially torn off. Incidents of direct structural damage, however, were limited.

“As devastating as the wind damage was in Rockport and surrounding towns, flooding from Harvey’s torrential rains has had the greatest impact,” explained Dr. Eric Uhlhorn, principal scientist at AIR Worldwide. “With a lack of large-scale atmospheric steering, Harvey’s motion was stalled resulting in extremely heavy and continuous tropical rainfall in a concentrated area. Harvey has already unleashed catastrophic and unprecedented flooding in southeastern Texas, and these conditions are expected to last for several more days. Louisiana is already experiencing heavy rainfall; the flood threat there will likely spread eastward once Harvey begins its northeastward path toward Houston.”

While the rainfall continues to soak Texas, with one location having recorded 40″ since hurricane Harvey’s impacts began, the expectation is that severe flooding will cause a significantly larger economic loss than the wind and surge.

Given the commercial and reinsurance related exposures to flood risk as well, particularly in cities such as Houston, there is the potential for the private insurance industry to take a larger flood loss than wind and surge loss from this storm, even with the NFIP’s role in flood insurance.

Harvey’s impacts are expected to continue, with the storm set to re-emerge over the Gulf before perhaps making a second landfall nearer to Houston later this week.

What this means is that the rain will persist and the flooding is not expected to peak for a few more days.

Dr. Uhlhorn commented on the rainfall and flood risk; “As a result of the unprecedented rainfall that has fallen in Houston and its surrounding areas, 66 of the 120 river gauging stations of the National Weather Service in Houston and Galveston are currently at various stages of flooding. By September 2, 74 of these gauging stations are expected to have flooded, about 50 of which will experience major flood stages.

“Many of the rivers in the area will crest with new record-setting flood levels. For example, the Buffalo Bayou, which flows through the downtown Houston area, is likely to crest at 73.0 feet, an astounding 11 feet higher than the previous historical record of 61.2 feet set in 1992. Similarly, Cypress Creek, which flows through neighborhoods north of downtown Houston, is likely to crest about 4 feet higher than the previous record of 94.3 feet set in 1949.”

AIR notes that only around 20% of homeowners in the region have flood insurance with the majority being NFIP flood policies.

With the NFIP already close to $25 billion in debt, AIR said that, “Harvey may well push the NFIP up against its borrowing limit of USD 30 billion and prompt action by lawmakers to reform the program, which is due to be reauthorized at the end of September.”

Just in Harris County alone, which includes the city of Houston, the NFIP holds more than 240,000 policies, representing more than $60 billion of exposures.

AIR also reports that personnel had been evacuated from 105 offshore energy production platforms, representing 14.25% of the manned platforms in the Gulf of Mexico. The Bureau of Safety and Environmental Enforcement (BSEE) estimated that around 21.64% of oil production in the Gulf has been shut-in and that 25.71% of natural gas production has been shut-in. As yet, there haven’t been any reports of significant structural damage to offshore assets as a result of Hurricane Harvey.

AIR said that its current estimate includes wind and storm surge damage within the extent of Harvey’s tropical storm-force and hurricane-force wind field.

This covers onshore residential, commercial, and industrial properties and their contents, automobiles, and time element coverage (additional living expenses for residential properties and business interruption for commercial properties; but not include business interruption losses resulting from the closure of oil refineries in the region).

At the estimated level, of up to $2.3 billion, the insurance and reinsurance industry loss from wind and surge is unlikely to trouble catastrophe bonds significantly, aside from an erosion of retention and deductibles under some aggregate cat bonds. Although important to remember that whether there was any impact to the Fonden 2017 Class B notes may have to wait for the final tropical cyclone report to be released by the NHC to become clear.

For private ILS and collateralized reinsurance there is exposure to the wind and surge losses, with further erosion of aggregate deductibles possible and also some small direct losses at this level, but nothing significant.

More significant could be any flood related losses from commercial and reinsurance related coverage in the area, particularly Houston, which could lead to some further small losses for collateralized reinsurance layers. Although this wouldn’t be expected to be particularly significant at this stage.

Fellow risk modelling firm Corelogic had also estimated the property insurance market impact from hurricane Harvey on Friday saying it could be up to $2 billion.

We’ll continue to update you as more information on the impact of hurricane Harvey to reinsurance and ILS emerges.

Also read:

– Cat bond market drops on Harvey, close shave for Fonden 2017 deal?

– Live cat trades completed on hurricane Harvey threat.

– Harvey makes landfall as Category 4 hurricane, 130mph winds.

– Half of hurricane Harvey loss could fall to reinsurance: J.P. Morgan.

– Hurricane Harvey – catastrophe bond exposure.

– As Harvey nears Texas, analysts highlight re/insurers risk of losses.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.