A hurricane Andrew-like category 5 storm that struck Florida in the Miami area could cause a loss of as much as $6.3 billion to the catastrophe bond market, with 25 individual cat bonds triggered and 47 tranches of notes taking losses, according to risk modelling firm AIR Worldwide.

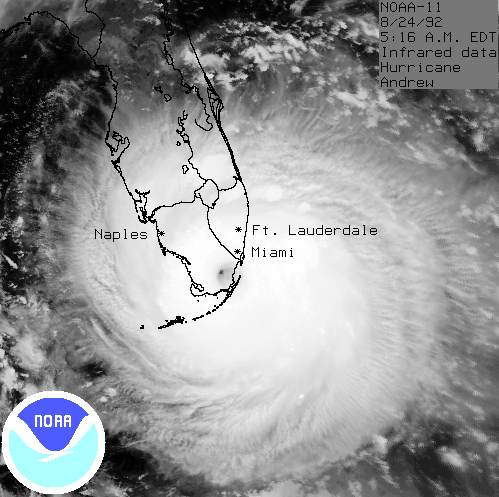

It’s coming up to 25 years since Hurricane Andrew struck Florida, becoming the largest insurance and reinsurance industry loss of its time at $15.5 billion.

It’s coming up to 25 years since Hurricane Andrew struck Florida, becoming the largest insurance and reinsurance industry loss of its time at $15.5 billion.

If hurricane Andrew was to recur today, AIR Worldwide estimates it would cause an insurance and reinsurance industry loss of around $57 billion, around 95% of which would come from Florida property damage.

“Category 5 Hurricane Andrew tore into South Florida on August 24, 1992, 17 years after the previous landfall of a major hurricane in that state,” commented Dr. Peter Sousounis, assistant vice president and director of meteorology at AIR Worldwide. “Andrew killed dozens and caused an estimated $15.5 billion in total insured losses, according to Property Claims Services® (PCS), and resulted in the insolvency of 11 insurance companies. The costliest natural disaster in U.S. history at the time, Andrew changed forever how (re)insurers approach hurricane risk management, spurring the growth of the emerging catastrophe modeling industry and ultimately prompting the development of insurance-linked securities.”

However, a similar hurricane Andrew-like storm striking just south of Miami could cause total insurance and reinsurance losses of over $138 billion, with losses in Florida alone exceeding $127 billion, with a significant hit expected to the catastrophe bond and insurance-linked securities (ILS) market.

Were a major Category 5 Andrew-like hurricane to strike Miami, landfalling between Palmetto Bay and Pinecrest, it would result in “immediate activity in the marketplace for insurance-linked securities (ILS),” AIR Worldwide said its models show.

AIR estimates that 25 catastrophe bonds would be triggered by such an event, with 47 tranches of notes subject to some level of loss, and 38 tranches of notes being completely exhausted by the loss event.

In total, AIR believs that such a hurricane event would cause a $6.3 billion loss to the catastrophe bond market, which based on Artemis’ current calculation of the market size being $29.87 billion would mean that 21% of outstanding cat bond market principal would be eroded.

If the catastrophe bond market took a 21% loss we would anticipate that the collateralized reinsurance market would take significant more, as it totals somewhere around $60 billion of risk capital outstanding in reinsurance contract collateral at this time.

Reinsurance sidecars could find themselves near exhausted in such a scenario and many reinsurance contracts would be paying out virtually in full to protect the most exposed primary insurance players, while retrocession would also be hit along with industry loss warranties (ILW’s), the majority of which trigger well below a $138 billion industry loss.

The overall result would be a major erosion of reinsurance capital, both traditional and alternative, raising the prospects of a race to recapitalise and to make coverage available again.

The industry is ready and able to respond to such a major event and that is exactly what the catastrophe bond and other collateralized property catastrophe reinsurance products were designed for.

So it is to be hoped that payouts would be swift and recapitalisation would also be rapid, as the ILS investor base would look to mobilise quickly to take advantage of any market dislocation.

It’s anticipated that a major loss such as this would result in a relatively clear-cut triggering scenario for cat bonds and ILS products, where as a smaller loss, where it’s less clear-cut whether instruments have been triggered, could result in a slower payout to ceding companies.

Industry loss and parametric triggers would likely payout first, while indemnity coverage could take more time.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.