Aon Securities, the insurance-linked securities (ILS) and capital markets arm of insurance and reinsurance broker Aon, reveals that all Aon ILS Indices posted a gain in the second-quarter of 2017, although returns were down when compared with a year earlier.

Aon’s ILS Indices track the performance of investment baskets of catastrophe bond transactions in the secondary market and, in Aon Securities’ Q2 2017 ILS market update, the brokerage reveals that all ILS Indices posted gains in the period.

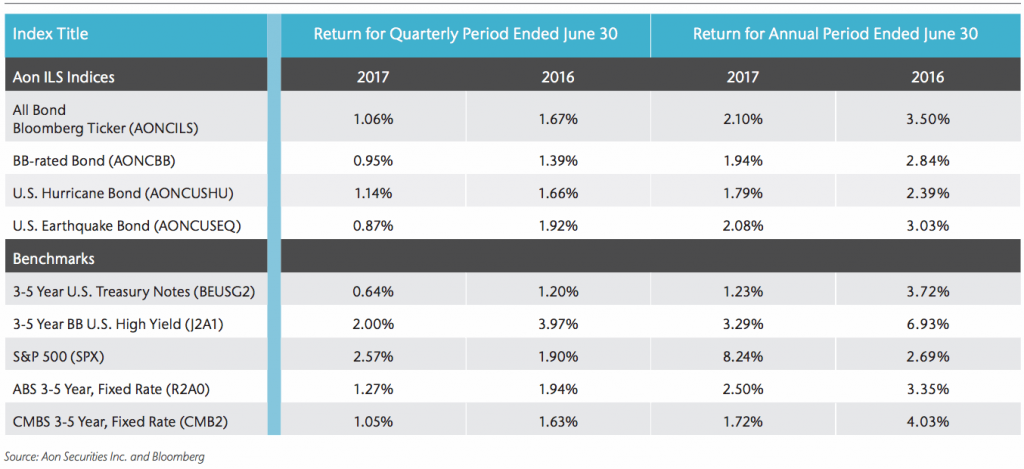

The greatest growth rate occurred in the Aon All Bond index and the U.S. Hurricane Bond index, which achieved growth returns of 1.06% and 1.14%, respectively. However, returns were down when compared with Q2 2016, when the Aon All Bond index and U.S. Hurricane Bond index achieved returns of 1.67% and 1.66%, respectively.

This trend was evident across the board, with the BB-rated Bond index and U.S. Earthquake Bond index recording gains of 0.95% and 0.87%, respectively. Compared with 1.39% and 1.92% in the second-quarter of 2016.

“Following in the same trend, the annual returns for all Aon ILS Indices achieved gains but did not surpass the prior year’s annual returns,” explains Aon Securities, and highlighted by the chart below.

For the six-month period ended June 30th, 2017, the Aon All Bond index and U.S. Hurricane Bond index recorded growth returns of 2.1% and 1.79%, respectively, compared with 3.5% and 2.39% a year earlier. The BB-rated Bond index and U.S. Earthquake Bond index reported returns of 1.94% and 2.08% for the period, respectively, compared with 2.84% and 3.03% a year earlier.

“The Aon ILS Indices performed with mixed results relative to benchmarks, but did outperform the 3 to 5 year US Treasury Notes Index,” explains Aon Securities, a trend that has persisted for some time now.

The 3-5 year U.S. Treasury Notes Index recorded a return of 0.64% in Q2 and 1.23% for the first-half of 2017, with all Aon ILS Indices outperforming the benchmark. However, at 2% for the second-quarter and 3.29% for the half-year, the 3-5 Year BB U.S. High Yield index outperformed all Aon ILS Indices, for both periods.

This was also the case for the S&P 500 index, which reported growth returns of 2.57% for the quarter and 8.24% for the half-year, and also the ABS 3-5 Year Fixed Rate index, which reported growth returns of 1.27% for Q2 2017, and 2.5% for the first-half of this year.

When compared with the CMBS 3-5 Year Fixed Rate index, Aon ILS Indices’ performance was mixed in comparison, with the index recorded growth returns of 1.05% for Q2 and 1.725 for the half-year, 2017.

“The 10-year average annual return of the Aon All Bond Index, 7.50 percent, outperformed the majority of the comparable benchmarks and reinforces the value of a diversified book of pure insurance risks for investors’ portfolios over the long term,” explains Aon Securities.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.