By the end of the first-half of 2017 and once all loss estimates are finalised, it’s expected that insurance and reinsurance industry losses from severe convective storms, thunderstorms, tornadoes, large hail and associated damaging winds in the United States will have exceeded $14 billion.

Reinsurance broker Aon Benfield’s catastrophe risk modelling and analytics unit Impact Forecasting tracks loss activity due to different perils and in 2017 the rapid pace of U.S. severe convective storm outbreaks have been the main driver of insured catastrophe and weather losses.

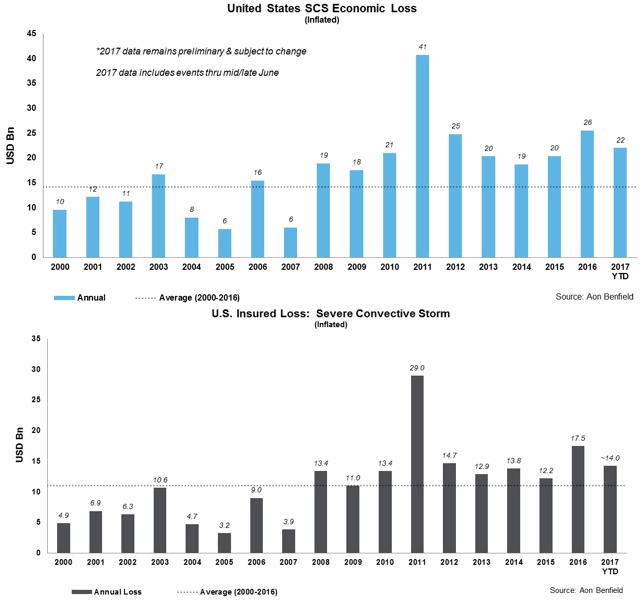

The insurance and reinsurance industry faces more than $14 billion of losses after the first-half severe storm activity in the U.S., while the economic loss is set for $22 billion or higher, putting 2017 as the fourth most costly year for both economic and insured losses due to convective weather activity.

Economic and insured losses from U.S. severe convective storms for H1 2017

The month of June 2017 has seen another $3 billion added to the insurance and reinsurance loss tally (which was around $11 billion at the end of May), as estimates rise on past events and new outbreaks of convective weather during the last month resulted in further damages that will fall to insurers, and in some cases reinsurers, ILS funds or collateralized reinsurance markets to pay for.

Steve Bowen, Impact Forecasting director and meteorologist, told Artemis; “The global insurance industry has been predominantly affected by the severe convective storm peril. More than three-quarters of global natural disaster claims payouts have been the result of SCS damage during the first six months of the year.

“More than 90 percent of those payouts have occurred with SCS events in the United States. We’re looking at first-half SCS losses in the US north of USD14 billion, which could end as the second-costliest 1H for the peril in the country on record – only behind 2011.”

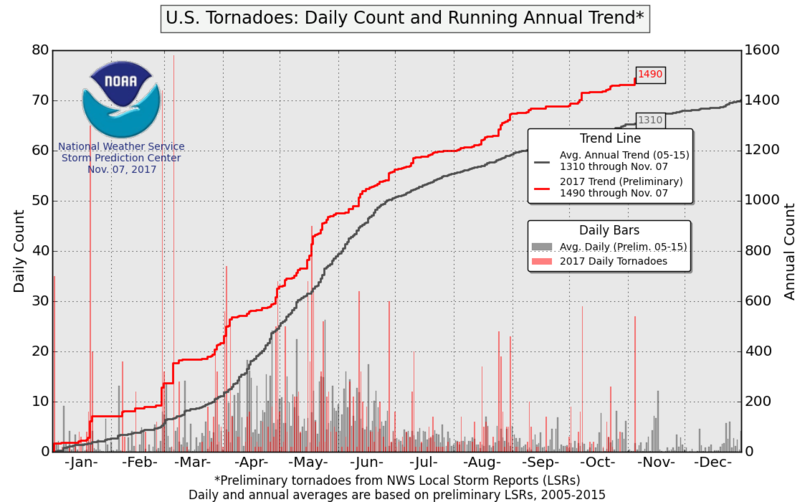

U.S. tornado counts continued to run well above the long-term average through June, so it’s no surprise that this has translated into a higher loss count for the insurance and reinsurance markets from the related perils..

Hail remains the largest driver of these losses though, with damage to automobiles, property and businesses from large hail fast becoming the leading driver of insurance and reinsurance losses in 2017 so far.

U.S. severe thunderstorm and convective storm activity has already impacted a number of reinsurance arrangements and ILS funds in 2017, with some insurance-linked securities (ILS) funds reporting returns in May were again impacted by attritional losses due to hail and tornadoes, as they had been in previous months as well.

At least one catastrophe bond has been impacted, the Skyline Re deal whose sponsor reported an aggregation of losses eroding the deductible sitting beneath the reinsurance that the cat bond provides, effectively raising the risk of loss slightly.

Severe convective storm losses are the main contributor to deductible erosion on aggregate reinsurance and ILS arrangements through the first-half of the year as 2017 shows that once again the risk may be rising for certain reinsurance and ILS contracts as aggregated losses mount up.

Bowen said that even if we don’t see another major severe convective storm loss for the rest of 2017, which is unrealistic to assume, the U.S. could see a top 3 or 4 year for SCS insurance and reinsurance losses anyway.

“It’s been a very active start to the year,” he said.

As the aggregation of losses from severe thunderstorms and convective weather events continues, the insurance or reinsurance industry loss will rise further and heighten the threat to any exposed aggregate reinsurance arrangements that have ILS fund and collateralized market participation on them.

Just over a week until our ILS Asia 2017 conference, get your ticket now.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.