U.S. military mutual insurer USAA has topped the Artemis catastrophe bond sponsor leaderboard after its latest cat bond transaction completed last Friday, adding $400m to 2016 issuance and taking total risk capital issued year-to-date to $5.327 billion.

The completion of USAA’s $400m multi-peril Residential Reinsurance 2016 Ltd. (Series 2016-2) catastrophe bond has helped to lift the cat bond issuance total above the $5 billion mark for the first time this year.

The transaction saw the insurer looking to expand its capital markets backed reinsurance coverage again, bringing the total number of cat bond issues sponsored by USAA to an impressive 28 since its first Residential Re cat bond back in 1997 (details of every USAA issuance can be found in the Artemis Deal Directory.)

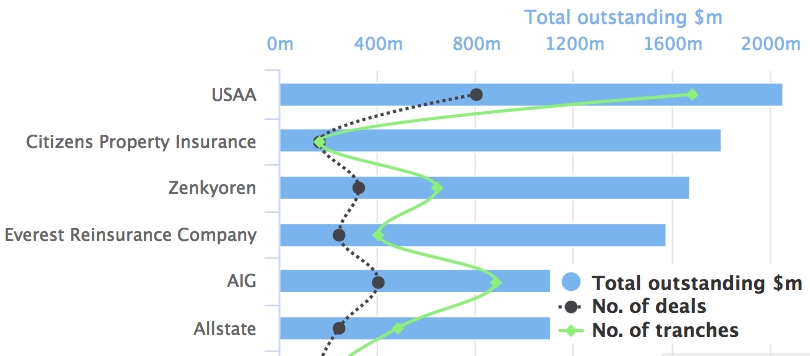

Despite how prolific USAA has been as a sponsor in the catastrophe bond market, the insurer had dropped down to third in the Artemis catastrophe bond sponsor leaderboard, after Florida Citizens and Japan’s Zenkyoren both overtook the company with their very large issuances.

But USAA has the greatest consistency in tapping the cat bond market for reinsurance coverage and its 28th transaction, Residential Re 2016-2, has taken the number of cat bonds currently outstanding in the market and sponsored by USAA to a stunning 10.

No other sponsor of catastrophe bonds has more than five transactions currently outstanding, which gives an idea of just how consistent USAA has been in its use of the capital markets for reinsurance capacity.

The 10 USAA sponsored cat bonds that are still outstanding consist of 21 tranches of notes and total an amazing $2.055 billion of reinsurance capacity currently in-force and sourced from the capital markets to protect the insurer against losses from multiple U.S. perils.

At $5.327 billion year-to-date, catastrophe bond issuance in 2016 is running a little behind other recent years, as you can see in our chart of cat bonds issued and outstanding here. But with two deals in the market which between them could add another $700 million and around six weeks left there is plenty of time for the annual total to rise further.

It does seem unlikely that we will see any new catastrophe bond issuance records in 2016, but with the outstanding cat bond market currently sitting at $25.77 billion and given the issuance left to come and $675m of scheduled maturities, we could see further outright growth of the outstanding market at year-end with $26 billion now in sight.

View all of Artemis’ catastrophe bond market charts and statistics here.

Join Artemis in New York on February 3rd 2017 for ILS NYC

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.