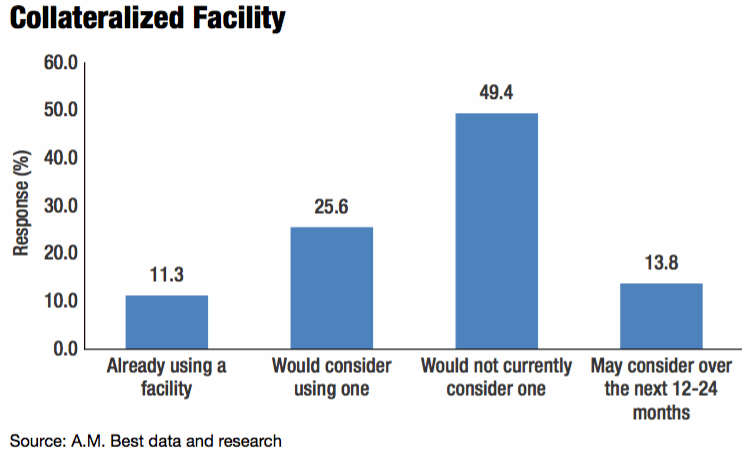

Just 11.3% of insurance and reinsurance firms surveyed by rating agency A.M. Best said that they were already using a collateralized facility within their reinsurance programs, but another 39.4% may use one within the next year or two, highlighting the continued potential for ILS market growth.

A.M. Best’s Spring 2016 Insurance Survey had several hundred respondent insurers and reinsurers, with 69.1% from the property and casualty sector, 24.7% the life and annuity market and 4.5% health. 95.2% of the respondents were primary insurers, with the remainder reinsurance firms.

The survey highlights the challenging and competitive market environment and looks to identify the issues, concerns and also motivations for the market as it navigates the softened price environment.

Overall, around 75% of the market are now targeting returns on equity of below 10%, but encouragingly 60% of respondents believe that economic conditions will not worsen considerably. 19.3% said that competition is their main concern, while interestingly 12.4% said antiquated business models are increasingly the main worry.

Reinsurance as a sector continues to experience fundamental changes, A.M. Best found, with almost half of the companies surveyed having made some structural changes to their reinsurance program in the last two years.

Cost is the main factor and over 70% of respondents who did restructure their program said that the outcome was more or better protection at a lower cost, something that the growth of collateralized reinsurance and insurance-linked securities (ILS), as well as the competitive nature of the market, will have assisted in.

Restructured reinsurance programs becoming the norm

When it comes to buying reinsurance and selecting counterparties security remains the biggest consideration for ceding companies, according to the survey results.

Over 40% of responses identified the security of the risk capital as key, which perhaps is a good sign for the collateralized reinsurance markets and ILS as the coverage is therefore as secure as possible.

Terms and conditions is the second largest consideration for reinsurance and retrocession buyers, as they seek to get the terms that provider them with the best and least restrictive coverage possible.

Perhaps surprisingly, price is the third largest factor for buyers of reinsurance which could simply be a reflection of the softened market and that price declines have slowed making buyers focus more on terms or security now.

More than half of the survey respondents have changed reinsurers in their panel over the last two years. Given security is the key consideration, but more than half are changing their panel of reinsurers, perhaps this is security of capital rather than the perceived security of one reinsurer over another. Again, this could be positive for the ILS market and fully-collateralized coverage, as ceding companies are clearly willing to change counterparties in order to gain greater confidence in the security of their coverage.

Cost is the second highest driver for changing reinsurer panel, again positive the ILS market, while relationship is now third, which perhaps reflects the willingness to change. Are protection buyers becoming less fixated on the relationship and more on security and cost?

A.M. Best then asked respondents specifically about their use of collateralized reinsurance facilities, and while only 11.3% said that they were already using one, almost 40% more said that it is a consideration.

25.6% of survey respondents said that they would consider using a collateralized reinsurance facility while another 13.8% said that they may consider it within the next year or two. However, at this time, 49.4% said that they would not consider a collateralized reinsurance facility right now.

Would insurers and reinsurers consider collateralized reinsurance?

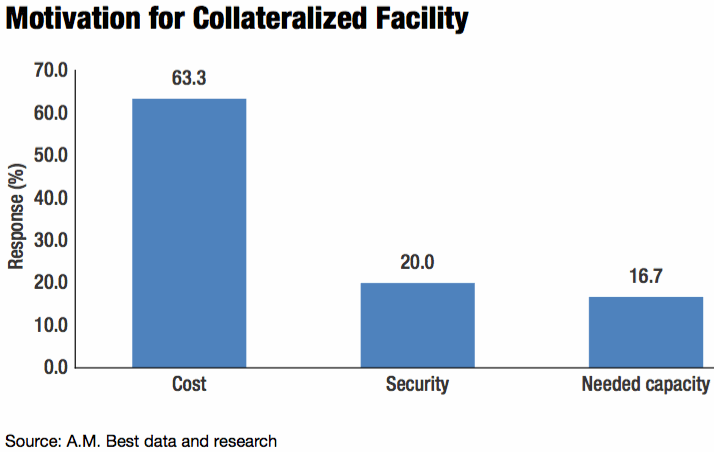

The key motivation for considering using collateralized reinsurance facilities is cost, according to A.M. Best, with 63.3% identifying this as the main factor. 20% of respondents identified security as the reason, which is encouraging as it shows a good sized contingent aware of the security of the collateralized reinsurance product.

Needing capacity is the final reason, with 16.7% saying that they would turn to ILS and collateralized reinsurance to fulfill capacity needs.

Why choose collateralized reinsurance?

ASo insurers and reinsurers clearly appreciate the low cost of ILS and collateralized reinsurance capital, and the security and availability of ILS capacity are also attractive it would seem.

With A.M. Best’s survey of over 200 identifying that ILS and collateralized reinsurance is attractive, but currently only used by 11.3% of the respondents, it’s clear that the market has significant growth potential just by bringing its products to a growing proportion of the market.

Increasing adoption of ILS and collateralized reinsurance is a matter of education and also familiarity.

As more re/insurers become familiar with the main ILS fund players and find they are here to stay, gain greater appreciation for the benefits of having a collateralized portion of their reinsurance programs and discover that their capacity needs can be fulfilled in the ILS market, it seems assured that growth will continue.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.