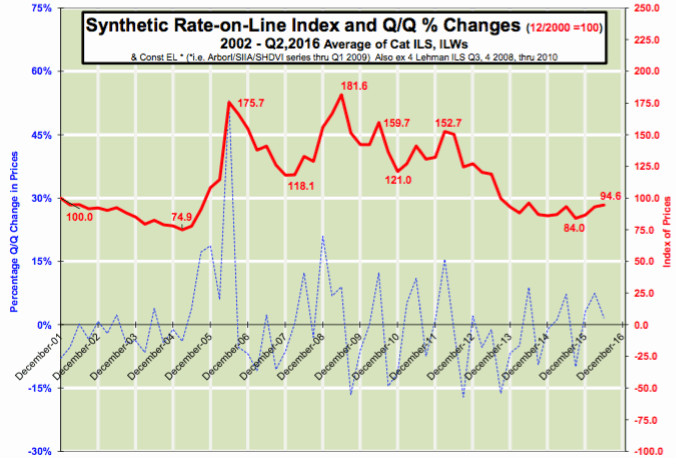

Catastrophe bond rates-on-line continued their trend of remaining stable through the second-quarter of 2016, with the Lane Financial LLC synthetic insurance-linked securities (ILS) rate-on-line index rising by 2% during the period.

Catastrophe bond and ILS rates-on-line have been recovering some ground over the last year, as average ILS rate hardening has become increasingly evident in the catastrophe bond and ILS market. But at the same time investors and ILS fund managers are taking on more risk, as expected loss levels are rising.

ILS consultancy Lane Financial’s synthetic rate-on-line index, which is constructed using data from ILS and ILW markets to provide an approximation of premiums being paid (or rate-on-line) for ILS and cat bond transactions, had risen 8% during Q1 to 93.1 at 31st March 2016. Now the index has risen another near 2% to close out the first-half of 2016 at 94.6.

Lane Financial LLC ILS Synthetic Rate-on-Line Index and Q/Q % Changes

The ILS market rate-on-line index now sits at its highest level in two years and the index has now risen steadily over three consecutive quarters.

The continued rise of catastrophe bond and ILW rates-on-line, as measured by this synthetic index, reflects the discipline within the market as managers and investors have sought to hold up pricing. Of course, it also reflects wider reinsurance market trends, and the fact that reinsurance rates are at or near a floor in many peak-peril regions of the world.

Declining rates do continue to be seen in some regions, particularly those where diversification can be wielded most strongly by the traditional reinsurance market, such as Japan, causing ILS and cat bond rates to slide a little further.

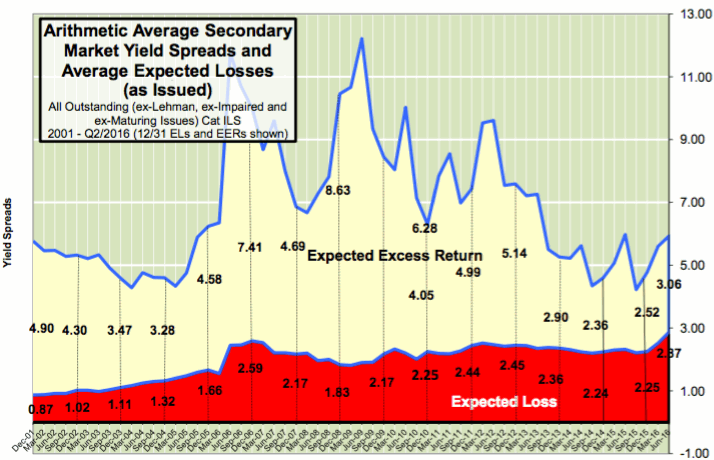

This trend is also reflected in the Lane Financial chart showing secondary market catastrophe bond yields versus expected loss at time of issuance.

The average excess return, so the yield above expected loss has risen over the last couple of years, reflecting the rate-on-line increases, but also noticeable is the fact that ILS investors are taking on more risk for this return, with expected loss up as well.

Average Secondary Market Yield Spreads and Average Expected Losses (as Issued)

As you can see from the chart above, taken from Lane Financial’s latest quarterly ILS market report, expected loss has risen rapidly and is in fact at its highest level ever, according to their data.

This is very much borne out by Artemis’ own analysis, with expected losses at the highest levels ever in 2016 issuance so far. And while the average coupon or yield paid has also increased, the multiple has come down further to its lowest level ever as well, suggesting investors are receiving a higher rate-on-line but at a cost of taking on more risk.

So while rates keep increasing, in recent quarters, the level of risk being assumed has been increasing too and as a result the return per unit of risk is at an all time low still (as reflected in the catastrophe bond average multiples).

That is a function of the softened market, with ILS fund managers and investors needing to maintain certain levels of return there is an appetite for higher risk transactions, which pay a higher coupon yield but have always come with a lower multiple.

We’d expect this trend to continue, particularly as sponsors become more familiar with the securitised ILS product and seek to use it lower down in their reinsurance towers.

You can download the report from Lane Financial LLC, which includes a discussion of reinsurance market returns, here.

Artemis’ Q2 2016 Catastrophe Bond & ILS Market Report – A quiet quarter fails to keep up with investor demand

We’ve now published our Q2 2016 catastrophe bond & ILS market report.

We’ve now published our Q2 2016 catastrophe bond & ILS market report.

This report reviews the catastrophe bond and insurance-linked securities (ILS) market at the end of the second-quarter of 2016, looking at the new risk capital issued and the composition of transactions completed during Q2 2016.

Q2 2016 issuance failed to hit $2 billion, with just $1.624 billion of new risk capital issued from 14 transactions, so not meeting investor demand. This is the first time since 2011 that issuance has failed to reach $2 billion, resulting in a decline in the outstanding market size from the record-breaking $26.516 billion seen at the end of Q1, to $25.174 billion.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.