78% of specialty Florida insurers remain untested in the event of a landfalling hurricane, with the last event occurring almost 11 years ago and owing to their location firms in the region are vulnerable to volatile underwriting results when compared with the rest of the U.S., according to Fitch Ratings.

Global financial services ratings agency, Fitch Ratings, has underlined that many growing property insurance companies in Florida have relatively brief histories, stating that 25 out of the 32 Florida specialists were formed in 2005, the same year the region last experienced a landfalling hurricane.

Hurricane Wilma, the last named storm to make landfall in Florida, occurred in October of 2005, a year which, along with 2004 highlights the volatile underwriting results Floridian specialists are susceptible to.

As a result of almost 11 years without a landfalling hurricane, insurers in the region have been able to replenish capital following the large losses in both 2004 and 2005, which ultimately improved capacity to withstand future events, says Fitch.

However, “many growing Florida property insurers have brief histories, untested by a large loss event, which creates uncertainty as to how these firms respond to next inevitable hurricane,” says Fitch, in a new report on the Florida homeowners insurance sector.

Current pressures in the global reinsurance marketplace and the recent rise of alternative reinsurance capital structures and ventures, has seen Florida specialty insurers benefit from efficient and diversifying available reinsurance capacity.

Fitch notes how a large number of insurers in the region have utilised reinsurance and insurance-linked securities (ILS) capital and features, including catastrophe bonds and collateralized reinsurance placements, to cede some of their exposures and improve capital strength.

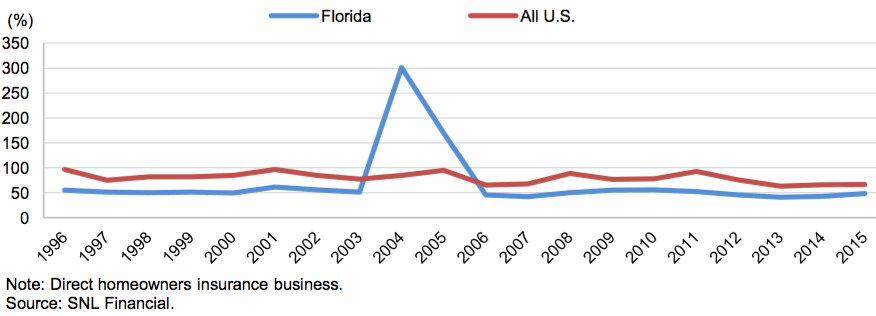

However, as highlighted by the chart below provided by Fitch, when large losses do occur, which the ratings agency says it inevitably going to happen again at some point, the underwriting results of Florida specialty firms can be extremely volatile.

Florida Versus U.S. Homeowners Insurance Direct Combined Ratio History

Typically, the combined ratio for Florida insurers fares better than the wider U.S. industry. But when disaster strikes, as evidenced in 2004 and 2005 when seven hurricane-strength storms made landfall in the region, the inherent volatility of the groups underwriting results can be seen.

In fact, Fitch states that during 2004 and 2005, the group of Florida insurers reported a combined ratio of 131.6% and 101.6%, respectively, highlighting just how susceptible to large losses insurers in the region remain.

Fitch stresses that it’s inevitable that a landfalling hurricane will again occur in Florida at some point, so it’s important that insurers in the area remain aware of this, and don’t fall into a state of “out of sight, out of mind.”

The balance sheets and infrastructure of almost 80% of Florida specialties remains untested by any significant loss event, which the ratings agency feels has the “potential for variations between modelled and actual losses for a given weather event” to be substantial.

“Also, the ability for these companies to quickly and effectively assess and pay losses during a substantial increase in claims volume a large hurricane landfall is uncertain,” says Fitch.

When the next large loss event does take place it will be interesting to see how the younger companies respond, and how much of a role reinsurance and ILS capital plays. In more recent years ILS structures and features have become more common in the overall insurance and reinsurance marketplace, so the underwriting volatility experienced in previous years might not be so significant.

That being said, only time will tell what the outcome will be for Floridian insurers, with the impact to firms likely being driven by the severity of the storm itself, and the utilisation of reinsurance and ILS capacity.

Florida homeowner insurers, like the wider U.S. marketplace, have benefited from the current buyers reinsurance market, as well as the growth of ILS, catastrophe bonds and other collateralized reinsurance products from ILS funds, and been able to replenish capital and prepare for the next big event.

But as underlined by Fitch, vulnerability remains a factor and the brief history of many companies in the market could create problems for those that downplayed the potential for future landfalling events, owing to no hurricanes making landfall since their establishment.

Perhaps a reflection of the uncertainty that surrounds some newer Florida insurers who have not yet experienced an active hurricane season, Florida property catastrophe reinsurance rates are thought to have been much more stable at the June renewal, dropping only -3.1% on average.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.