Rating agency A.M. Best has published a new draft rating methodology of relevance to the catastrophe bond, insurance-linked securities (ILS), ILS fund and collateralised reinsurance space and is seeking comments from market participants.

This week the rating agency published Best’s Insurance-Linked Securities & Structures Methodology (BILSM), a new draft document summarising A.M. Best’s approach to rating insurance-linked securities and insurance-linked structures (ILS).

A.M. Best wants the document to act as a “forum for discussion with analytical staff and also will be the ongoing central repository for Best’s Idealized Issue Default Matrix and Best’s Idealized Issuer Default Matrix.”

Once this new ILS rating criteria document is completed and released for use, the default matrices in BILSM will supersede existing versions of default matrices in other currently published rating criteria. The document also offers readers an insight into what information A.M. Best would need, key considerations when rating an ILS structure, risk modeling requirements and surveillance activities that would generally apply when rating ILS transactions.

Not every ILS transaction or structure would be rated using this new methodology, A.M. Best notes, explaining that some are rated using structured finance technology and therefore would be evaluated using this new BILSM methodology. While other ILS transactions that appear more like an insurance companies would be evaluated based on Best’s Credit Rating Methodology (BCRM).

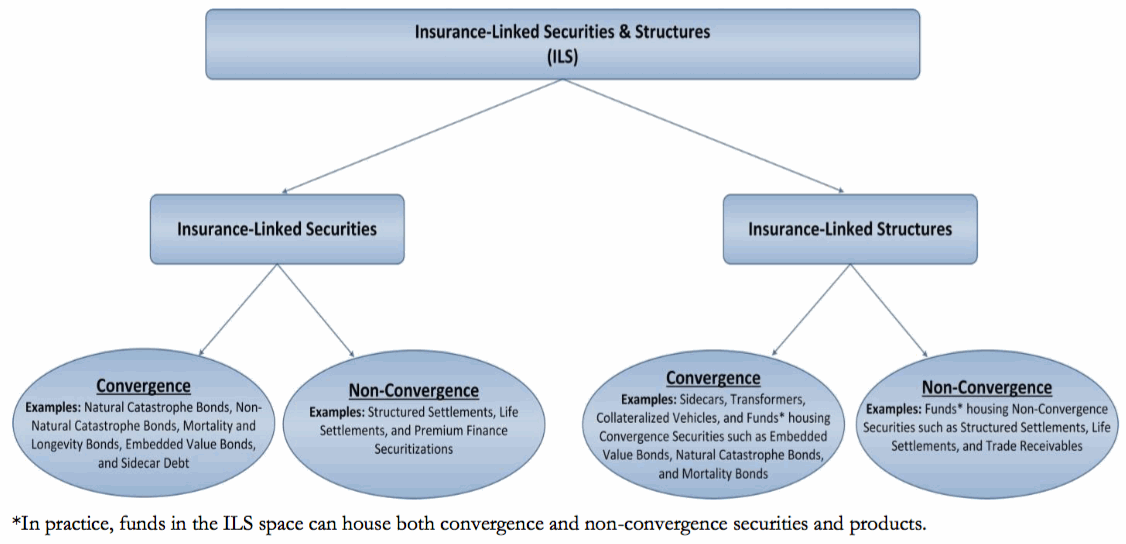

Interestingly, A.M. Best differentiates between some types of ILS transactions in a new way, calling them either ILS convergence transactions or ILS non-convergence transactions.

A.M. Best explains ILS convergence transactions as; “Securities or structures sponsored by insurers/reinsurers that are designed to transfer risk and attract capital from the financial services industry, particularly the capital market.”

So that includes the ILS deals and structures we focus on here at Artemis, such as catastrophe bonds, securitisations of insurance risk, sidecars, ILS funds etc.

Meanwhile, ILS non-convergence transactions are explained as; “Securities or structures that are collateralized by insurance-related assets whereby the transactions are not sponsored by insurers or reinsurers and do not provide capital relief to the insurers or reinsurers.”

Examples of the non-convergence ILS transactions include structured settlement securitisations and life settlements, A.M. Best says.

The reason for making this distinction, of convergence or non-convergence ILS transactions and structures, is because “ILS convergence transactions can involve two types of risks that are borne by their sponsors—tail risk and basis risk” A.M. Best continues.

These risks, while not considered when rating ILS transactions, can affect the required capital calculations for insurance or reinsurance entities that sponsor them as a risk transfer mechanism.

A.M. Best’s new methodology provides a really useful graphical breakdown of the different types of ILS securities and structures, both convergence and non-convergence.

Insurance-Linked Securities & Structures

A.M. Best explains that the most common structures of ILS transactions can typically be classified within four main categories: asset-backed security, liability, value-in-force, and ILS fund. Structures can receive a Best’s Issuer Credit Rating (ICR), a Best’s Financial Strength Rating (FSR), or a Best’s Issue Rating (IR).

A.M. Best details what information would be required for a rating to be considered and assessed for an ILS transaction or structure, and also explains the drivers and considerations that will be taken into account when assessing any ILS security or structure.

As with other insurance or reinsurance ratings, A.M. Best will monitor and provide surveillance on an ILS transaction or structure for the duration of its term, with ratings updated as and when appropriate.

It’s interesting that A.M. Best has elected to put forward an ILS rating methodology that encapsulates so many of the market’s transactions and structures at a time when ratings for ILS and catastrophe bonds are at an all time low.

It’s also interesting that ILS funds are again mentioned, A.M. Best has previously put forwards a rating criteria for insurance-linked funds, including those investing in catastrophe bonds, ILS and collateralized reinsurance, but as yet it has not been used as far as we’re aware.

A rating for more ILS securities, structures, funds, sidecars and transactions would be useful, for investors and counterparties seeking information, a benchmark and assurance about opportunities and counterparties.

However the cost of ratings is one factor that has reduced the use of ratings in ILS, as well as the fact that less and less investors are demanding them (especially on cat bonds).

But there is without a doubt a place for a robust rating criteria, from a range of rating agencies, and they will continue to be used and provide valuable diligence and reference for the ILS market.

So, as we would always say, it’s important for the ILS market to have its say and provide its comments to A.M. Best, to ensure that the proposed Best’s Insurance-Linked Securities & Structures Methodology (BILSM) meets the needs of the investor, sponsoring ceding company, investment fund manager and other interested parties.

You can download the draft methodology here and written comments should be submitted by email to [email protected] no later than June 16, 2016

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.