The use of industry loss triggers in risk transfer transactions such as catastrophe bonds and other private ILS or collateralised reinsurance arrangements, decreased in recent years as high levels of re/insurer equity capital and competition from indemnity triggers affected uptake.

Industry loss calculations and indices provide a useful proxy for insurance losses for major catastrophic events that hit the insurance and reinsurance industry. As a result they are widely used in transactions, where the protection buyer wants to receive a payout if a catastrophe event causes an impact of a certain magnitude to the re/insurance industry.

Industry loss triggers are most frequently seen in industry loss warranties (ILW’s), which are private transactions, often used for reinsurance and retrocession and structured as derivative on insurance with a nominal indemnity clause. After ILW’s the most common use is likely the industry loss catastrophe bond, the Rule 144a securitised, usually multi-year transactions.

But use of the industry loss trigger has declined, at least in Europe according to data released by PERILS AG, a provider of industry-wide European catastrophe exposure, industry loss data and indices.

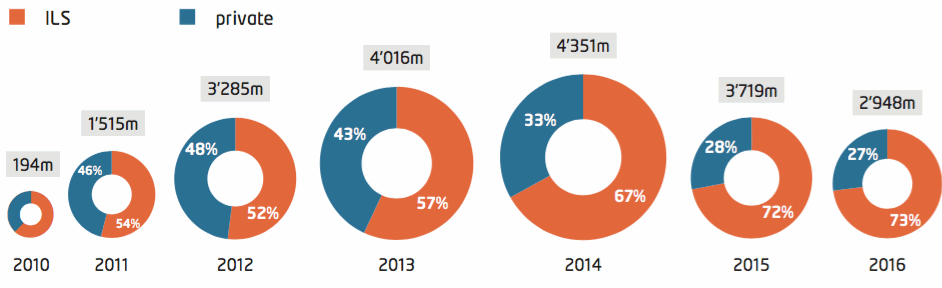

PERILS latest newsletter shows that use of its data in risk transfer transactions has decreased in recent years, with PERILS-based limits at risk lower than seen in 2012 at the 31st March 2016.

$2.9 billion of PERILS-based limits were at risk, so effectively reinsurance and retrocession transactions at risk which utilise PERILS data industry loss triggers, at the end of Q1 2016, with over 90% based on structured triggers using a weighted industry loss index.

Over 80% of the limits at risk were used for retrocessional reinsurance purposes, PERILS said. Industry loss triggers are perhaps most appropriate for reinsurers retro needs, given the broad regional or countrywide coverage they require, which makes the loss experience of the insurance industry a good proxy for their own losses.

73% of the PERILS-based limits at risk at the 31st March were from 144a catastrophe bond transactions, with the remaining 27% put to work in private ILS and reinsurance deals, such as ILW’s.

PERILS-based limits at risk in USD, 2010 to 2016 (per end March)

Since the 1st January 2010 a cumulative total of $11.8 billion of limits have been at risk using PERILS industry loss triggers, from 180 transactions. At the end of Q1 2016 the $2.9 billion of PERILS-based limits at risk consisted of 26 PERILS triggered transactions.

The decrease in limits at risk using PERILS triggers since the peak in 2014 has been most pronounced in private transactions, according to PERILS, with ILW’s and swap structures declining 55% and 144a catastrophe bonds declining 27% in that time.

PERILS explains two key reasons for the decline in use of the industry loss trigger.

First the high levels of capital and equity in the re/insurance industry, which facilitates greater retention of risk and can result in less risk transfer being used. It’s worth noting that at the last renewals this trend does appear to be reversing slightly, and greater use of reinsurance and retro capacity is being seen once again.

The second reason is ongoing competition from indemnity covers, which are incredibly competitively priced and has served to reduce uptake of industry loss triggers and also parametric triggers in recent years.

Competition from indemnity triggers is of course linked to the first point, as well capitalised reinsurance firms look to put capacity to use and compete strongly with ILS and alternative sources of reinsurance capital.

This has resulted in indemnity covers becoming incredibly cheap in some peak peril zones, particularly Europe where PERILS has to date been so focused. With coverage such as European windstorm reinsurance and retro available for pricing not far above expected loss, from many of the largest reinsurers, it has been hard for ILW and cat bond capacity to compete, resulting in the industry loss and parametric trigger decline.

However, PERILS notes that the impact of indemnity competition is less pronounced in retrocession, which is perhaps the sweet spot for the industry loss trigger, due to reinsurers broad exposure to the insurance industries loss experience.

In fact, the use of industry loss triggers continues to be seen in retrocessional cat bonds. However many of these are U.S. peril focused and the European windstorm risks are becoming an increasingly rare feature of the cat bond market, again due to the competitive price of indemnity coverage.

It will be interesting to see what happens when the re/insurance industry faces some large losses and pricing rebounds, even a little. The industry loss trigger could become extremely popular again, particularly if we saw a large European windstorm loss, or U.S. hurricane loss.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.