The first-quarter of 2016 witnessed a record volume of catastrophe bond and insurance-linked securities (ILS) issuance, helped by continued investor appetite that met the capacity targets of market sponsors during the period, according to reinsurance giant Munich Re.

As highlighted and explored in the Artemis Q1 2016 Catastrophe Bond & ILS Market Report, a record $2.215 billion of issuance came to the market in the first-quarter, a record for the space.

Reinsurer Munich Re in its recently published Q1 2016 ILS Market Update has also discussed the record-breaking volume of issuance seen in the opening three months of the year. Noting that the sector has “built on the momentum seen towards year-end 2015 with even more deal activity during the first quarter of 2016.”

As recorded by the Artemis Deal Directory the $2.215 billion of issuance came from ten transactions, which ensured the ILS and cat bond market ended the quarter with an outstanding volume of $26.516 billion, another record for the sector.

Global reinsurer Munich Re notes that the strong level of issuance seen during the quarter was helped by continued sponsor demand and accompanying investor appetite.

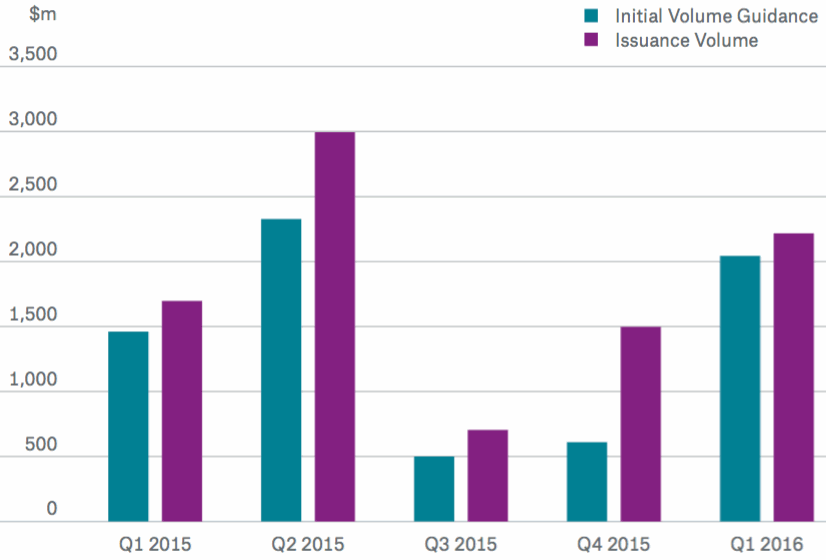

“Overall, the capacity initially targeted by sponsors was well-matched by investor liquidity, with total issuance volume only surpassing initial volume guidance by $170 million, indicating that sponsors were able to tap the full buy-side potential this quarter,” said Munich Re.

Essentially this means that sponsors of ILS and cat bond transactions during the first-quarter saw capacity demands met across issued transactions, as investors appeared willing to assume as much risk that was brought to market.

ILS Issuance Volume vs. Initial Volume Guidance ($m) - Source: Munich Re

As the above chart shows, which was provided by Munich Re, issuance volume for the last five quarters has surpassed initial volume guidance, underlining the consistent appetite among a range of ILS investors to be active in the space regardless of volatility in the global reinsurance landscape.

Significant pressure on rates in the insurance and reinsurance industry remains, as a host of market challenges seen in 2015 have persisted this year.

But in spite of this the catastrophe bond and broader ILS market continues to expand, actually growing its share of the overall reinsurance market to 12% by the end of 2015, which amounts to approximately $72 billion, according to reinsurance broker Aon Benfield.

So it’s clear that as the ILS market continues to expand its footprint within the risk transfer landscape, both investors and sponsors are becoming more sophisticated and grasping a better understanding of the asset class and its features.

The increased maturity of ILS investors and a greater willingness to better understand exposures within the sector looks to be supporting continued market growth.

Despite persistent rate declines and further pressures in the international re/insurance industry ILS continues to show its uncorrelated and diversifying benefits to investors and sponsors a like, underlined by its impressive growth trend at times of wider financial market volatility.

You can access Munich Re’s quarterly catastrophe bond and ILS market reviews here.

Artemis’ Q1 2016 Catastrophe Bond & ILS Market Report – Another record first-quarter

We’ve now published our Q1 2016 catastrophe bond & ILS market report.

We’ve now published our Q1 2016 catastrophe bond & ILS market report.

This report reviews the catastrophe bond and insurance-linked securities (ILS) market at the end of the first-quarter of 2016, looking at the record $2.215 billion of new risk capital issued and the composition of the cat bond & ILS transactions completed during Q1 2016. The report also includes a review of global property catastrophe reinsurance pricing trends and commentary on dedicated reinsurance sector capital from co-editor GC Securities.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.