Continuing to accelerate the rate of decline witnessed in the last few months, U.S. commercial P&C rates were down by -4% in December, as the battle amongst insurers for market share continues, according to the latest commentary from MarketScout and KBW.

The pricing environment in the global insurance and reinsurance market has remained pressured for some time now, with excess capacity in the reinsurance market overspilling into primary insurance lines, resulting in a fight for market share and intense competition.

At the same time there is a growing amount of alternative capital looking to access U.S. commercial and large property insurance risks directly, through fronting or arrangements with managing agents. This looks set to exacerbate the softening in commercial P&C and could actually accelerate the declines into 2016.

Commenting on the current pricing landscape, MarketScout Chief Executive Officer (CEO), Richard Kerr said; “Market cycles are part of our life, be it insurance, real estate, interest rates or the price of oil. Market cycles are going to occur without question. The only questions are when, how much and how long. While it may seem the insurance industry has already been in a prolonged soft market cycle, we are only four months in.”

Adding; “The market certainly feels like it has been soft for much longer, because rates bumped along at flat or plus 1 to 1.5 percent from July 2014 to September 2015. The technical trigger of a soft market occurs when the composite rate drops below par for three consecutive months.”

It’s not surprising to hear Kerr discuss the market in this manner, and with further pressures at January renewals for reinsurance entities, exacerbated by the continued presence of alternative reinsurance capital and the benign loss environment, it’s unlikely U.S. P&C rate declines will significantly alter anytime soon.

Analysts at Keefe, Bruyette & Woods (KBW) echoed this notion; “We expect rates to remain pressured in 2016 and beyond as companies fight for share, in part on lower expense bases. We remain pretty neutral on primary commercial insurers: rates trailing loss cost trends makes underwriting margin improvement almost impossible, especially if reserve development fades further.”

Broken down by account size, MarketScout reveals that during December 2015 all account sizes experienced declines, with the steepest, at -5%, occurring with Large ($250,001 – $1 million) sized accounts. Both medium ($25,001 – $250,000) and jumbo (over $1 million) sized accounts reported 4% declines, while small (up to $25,000) sized accounts experienced a 3% dip during the month.

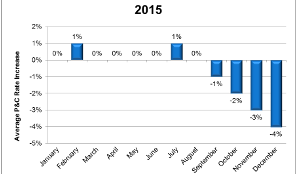

The chart below from MarketScout shows the U.S. P&C insurance rate environment through 2015, with rates turning negative in September 2015.

2015 commercial P&C rate changes by month - Source: MarketScout

This second chart shows the U.S. average P&C rate trend of the last 15 years, which shows an average decline of -1% for 2015 as a whole. It also shows that while softening, the U.S. P&C market is by no means truly soft yet and that’s an important distinction, as now we see alternative capital beginning to flow more directly to these markets efficiency of capital could prolong this softening for longer than in previous cycles.

U.S. average P&C insurance rate trend by year - Source: MarketScout

“It seems the length and veracity of the market cycles has become less volatile in the last five or six years. Thus, the impact of a hard or soft market in today’s environment may be 5 or 6 percent up or down,” said Kerr.

Adding; “Underwriters today have better tools to price their products and forecast losses. Further, the chances of a rogue underwriter or company are greatly reduced by the industries’ checks and balances. There may be less excitement but there are probably far fewer CEO heart attacks.”

It’s expected that re/insurance market capacity will continue to find its way into primary business lines, and commercial business will likely continue to feel the impact of the current supply/demand imbalance in the global reinsurance market, a trend that shows no signs of letting up anytime soon.

Also read:

– U.S. commercial P&C rate declines accelerate in November.

– U.S. commercial P&C rates down 3.1% in Q3, softening continues.

– P&C re/insurance pricing outlook bleak over next 18 months: Moody’s.

– U.S. commercial P&C insurance rates decline in September.

– U.S. commercial P&C rate movements back to flat in August.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.