Following four months of flat rate movements across U.S. commercial property and casualty (P&C) lines, MarketScout’s latest P&C insurance barometer reveals a 1% increase during July.

Richard Kerr, Chief Executive Officer (CEO) of MarketScout, commented; “The property market often tightens a bit on the cusp of wind season but, we also noted slight increases on other lines of coverage as well.”

Commentary from analysts at Keefe, Bruyette & Woods (KBW) notes that despite the positive move, away from flat or declining rate movements in the U.S. commercial P&C sector, it’s predicted to be an irregularity.

“We believe this is an anomaly, and we expect rates to turn modestly negative in the coming months as the industry adjusts to significant excess capital. We were surprised by the sequential uptick, ” said KBW.

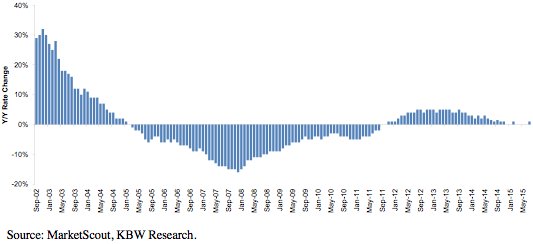

Commercial P&C insurance rate changes

The influx of alternative reinsurance capital, which adds to the base of traditional sources of reinsurance capacity, continues to enter the sector adding pressure to pricing and filtering down into primary lines, particularly impacting commercial property lines.

Broken down by account size, MarketScout’s Barometer reveals that small (up to $25,000) sized accounts reported the largest increase, of 2%. While medium ($25,001 – $250,000) sized accounts reported a 1% increase during July, and large ($250,001 – $1 million) sized accounts remained flat. The most significant decrease was witnessed in jumbo (over $1 million) sized accounts, which as in June reported a 2% decline.

KBW highlight that year-on-year rate changes in the U.S. commercial P&C space reveal that July 2015 experienced a 0.5% decline, compared with a 2% decline in June, as shown in the chart below.

Commercial P&C insurance rate changes year-on-year

Commenting on this, KBW said; “We believe that this underlying cycle effectively predicts near-term pricing behaviour, the second derivative has remained negative YTD, and we think it points to more near-term pricing pressure and again, we view this more as a fluke than a real inflection point.”

Interestingly, KBW’s analysts note that commercial property rates ticked up around 2% in July, according to MarketScout data, which the analysts say is in contrast with insurance company commentary during the Q2 results which suggested a fall of around -5%. This anomaly may become clearer over future months and quarters.

Looking to the future KBW’s outlook for the sector remains in line with previous months, despite the surprising uptick in rates during July.

“We expect rate changes to turn modestly negative over the next few months,” warned KBW.

Also read:

– Softening commercial P&C insurance market down 3.3% in Q2.

– New capital softening U.S. commercial property rates: Marsh’s Ellis.

– U.S. commercial P&C rates flat again in June: MarketScout.

– Reinsurance capital glut to ultimately weigh on P&C stocks: A.M. Best.

– U.S. commercial P&C rates flat for third month running: MarketScout.

– U.S. commercial P&C insurance rates flat in April.

– U.S. commercial P&C rates flat in March as gains stop after February.

– Softening causes 2.3% commercial P&C rate decline in Q1: KBW, CIAB.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.