With reinsurance rates dropping at the January 2015 renewal, with little uptick in demand, investment returns remaining depressed and competition very high, A.M. Best notes that managing the reinsurance cycle and selecting the best risks is increasingly key.

One of the ways reinsurance companies are employing cycle management and active risk selection is in the general reduction in underwriting of catastrophe risks that has been noted by rating agency A.M. Best in a new report titled ‘Global Reinsurers: Who Will Gain Despite All the Pain?’. Despite the excess capital, competition and rate reductions, Best notes that the reinsurance sector is usually disciplined and shows resilience to market factors.

However, with competition from both traditional reinsurers as well as from insurance-linked securities (ILS) specialists and alternative reinsurance capital providers seemingly at an all time high, the margins on underwriting have dropped and as a result discipline is more important than ever, A.M. Best says.

The challenging market conditions are expected to continue throughout 2015, with further price declines possible, terms and conditions expected to become even more broad, ceding commissions to drop and competition likely to heat up even more. As a result reinsurers have to employ cycle management in order to build a sustainable portfolio of risk that allows them to hit their hurdles.

In 2014 the result of cycle management and risk selection has been a reduction in the property catastrophe portfolios at many major reinsurers, while they shift capacity to lines of business that meet required return rates. 2015 is expected to result in an even more measured approach to risk selection, A.M. Best says.

This “orderly approach to risk selection” seems to be working for the big, global reinsurance firms, Best explains, and it expects them to remain cautious on the business they choose to underwrite as market capacity remains high along with corresponding competition for risks.

A.M. Best again highlights that reinsurers with a primary insurance operation are benefiting, by being able to divert capacity to put to work in the primary lines where rate declines are not yet evident, or not as steep as in reinsurance.

However, those reinsurers that only write reinsurance business and focus on their underwriting are; “In danger of reducing their books of businesses to levels that may render them less relevant in the market, which could lead to more merger and acquisition activity,” A.M. Best explains.

Scale and diversification remain key for reinsurers and A.M. Best believes that the larger reinsurers are only going to get bigger, as smaller players are consumed or put themselves up for sale. That could result in a much smaller reinsurance market, in terms of players, with fewer, larger, more diverse reinsurance companies dominating the landscape.

Pricing pressure remains and the continued inflow of alternative capital and ILS funds are exacerbating the issue and also applying their lower-cost capital to global property catastrophe reinsurance risks. ILS capital may be partly responsible for causing reinsurers to shrink their property catastrophe books, and with ILS capital likely most efficient for assuming some peak peril zone risks this trend could continue, helping ILS to grow its market share further.

A.M. Best explains; “With new capital and reduced reinsurance purchasing by some large cedents, market conditions are expected to remain challenging for the reinsurance business in 2015 and lead to further pressure on pricing, particularly in property and cat lines.”

There continues to be an expectation that pricing pressure will broaden out to other areas of the reinsurance market as well, which could result in more active cycle management in other lines of business, again shrinking options for some reinsurers.

“The intensified competition in property reinsurance and cat continues to spill over to other lines of reinsurance and geographies as companies attempt to expand their product offerings and global presence. This, in turn puts still more upward pressure on ceding commissions for quota-share placements and is leading to more multiyear contracts, broader contract terms and increased signings on aggregate covers,” A.M. Best explains.

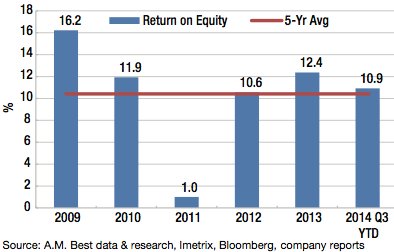

Despite all the issues, much of the reinsurance market continues to deliver sold return on equity (ROE’s) for the moment. However, as the pressure persists, pricing remains depressed and investment returns show no signs of increasing, A.M. Best expects reinsurer ROE’s will settle into the single digit range for some time for most, if not all, reinsurers.

U.S. & Bermuda – Reinsurance Return on Equity - Source: A.M. Best

At that point it has to be considered how reinsurer shareholders will respond. Used to double-digit ROE’s a sustained period of returns in the single digits may not be palatable to many shareholders which could result in some pressure on reinsurer valuations. It’s also sure to push reinsurers to try new ventures, partner even more deeply with alternative capital, look to enter primary lines or other areas of reinsurance and ramp up the M&A pressure even further.

“Returns are expected to become even more challenging if capital continues to enter the market at such a high rate, reserve releases decline, and pricing continues to soften in the double digits,” A.M. Best continues.

A worst case scenario of lower ROE’s and an uptick in the combined ratio is possible, Best notes, particularly if price declines spill over into the primary business at an ever faster rate in 2015.

Challenges are set to continue and A.M. Best notes that further margin compression is possible as third-party capital continues to take market share and broaden its reach.

A.M. Best forecasts; “Underwriting performance for the United States and Bermuda to produce an average combined ratio of 94.8 and an average ROE of 8.2% for 2015, representing a stubbornly difficult market environment and a normal level of catastrophe activity.”

The expense ratio is, of course, going to increase in importance, as is the longevity of positive reserve releases. Some reinsurers have been boosting their ROE’s thanks to continued positive reserve releases, which may mask the real effects of the markets pressure on their combined ratios.

U.S. & Bermuda - Reinsurance Combined Ratio Trend - Source: A.M. Best

With capital set to continue increasing, interest from institutional investors in catastrophe risks and reinsurance still ramping up, catastrophe losses remaining low and no sign of pricing or asset side recovering at all, the outlook remains negative for the reinsurance sector.

Cycle management and disciplined risk selection may protect reinsurers for some time, particularly those with global scale and diversification, however it will not protect them forever if ROE’s drop to single digits. At that point the value proposition of a reinsurer may need a complete overhaul, as more efficient business models and capital become essential in order to survive at such low returns.

Also read:

– Global reinsurance sector outlook remains negative: A.M. Best.

– What happens when the music stops (reserve releases run dry)?

– Reinsurers expense management & efficiency increasingly important.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.