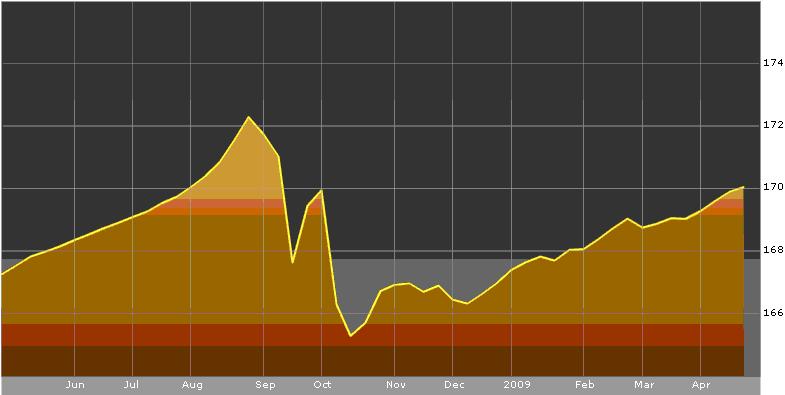

Now that the catastrophe bond market is looking more healthy and issuance has returned to normal levels it’s a good time to take another look at the Swiss Re Cat Bond Total Return Index to see how that indicator of market health is responding. The index tracks the total rate of return for all dollar-denominated bonds so is a good indicator of investor appetite and market health.

As you can see the index is continuing it’s recovery and is now heading back towards it’s all time highs of last August (before the market ground to a halt). Given the pipeline of deals waiting to come to market we can expect this rise to continue for the next few months. You can chart the index on Bloomberg here and we will continue to provide monthly updates.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.